Aberdeen Md Taxes . maryland department of assessments and taxation. the city’s current tax rate is $0.625 per $100 of assessed value. Real property data search ( ) guide to searching the database. $0.625 per $100.00 of assessed value. Please enter in one of the following to view or select the associated tax bill. Real property taxes are assessed and billed on july 1 of each. About water & sewer payments. welcome to harford county bill pay. the maryland department of assessments and taxation administers and enforces the property assessment and property tax. Water and sewer bills are based on a customer’s water usage. 9 rows real property tax rates: 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return.

from www.formsbank.com

welcome to harford county bill pay. Water and sewer bills are based on a customer’s water usage. 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return. 9 rows real property tax rates: the city’s current tax rate is $0.625 per $100 of assessed value. $0.625 per $100.00 of assessed value. Please enter in one of the following to view or select the associated tax bill. Real property taxes are assessed and billed on july 1 of each. Real property data search ( ) guide to searching the database. About water & sewer payments.

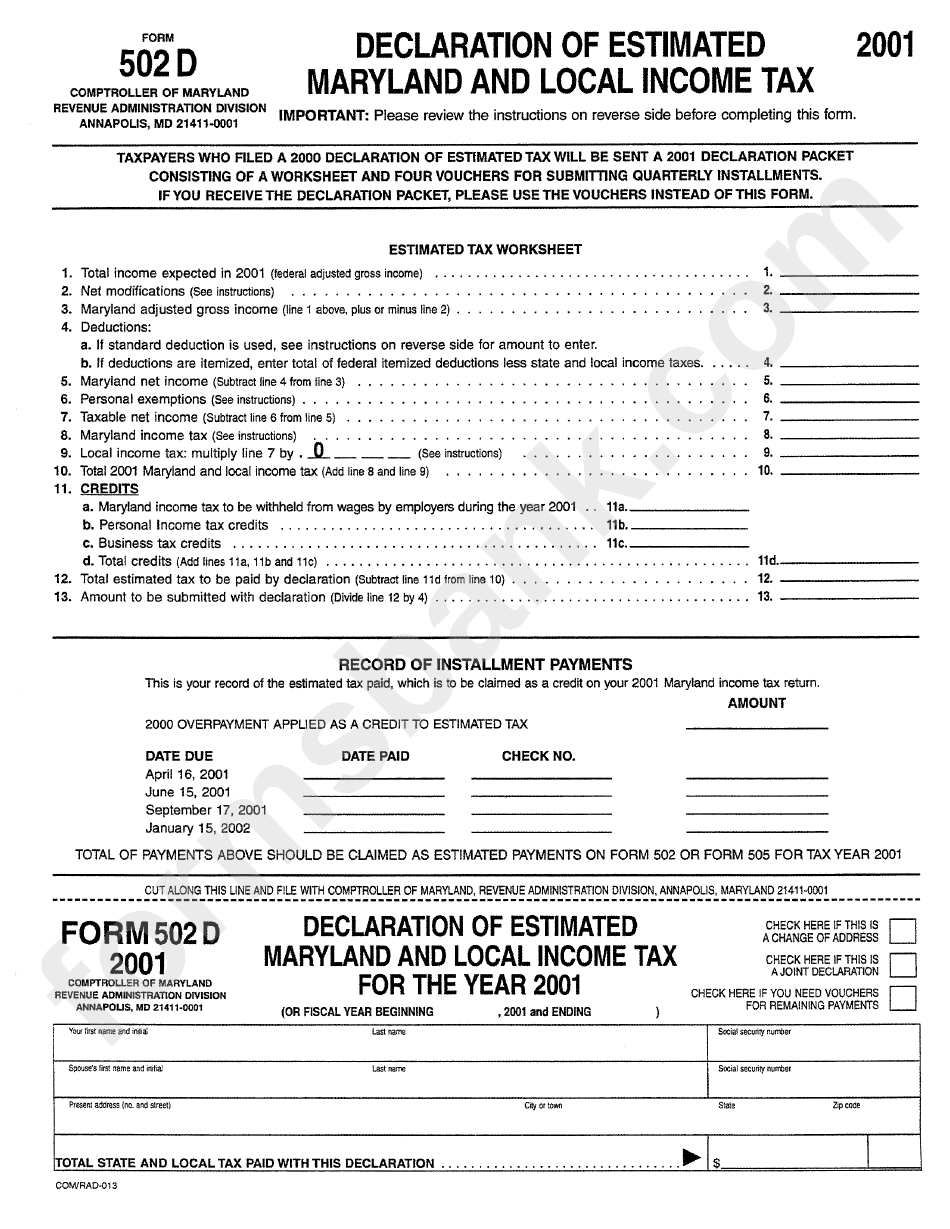

Form 502d Declaration Of Estimated Maryland And Local Tax

Aberdeen Md Taxes maryland department of assessments and taxation. Water and sewer bills are based on a customer’s water usage. About water & sewer payments. 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return. the city’s current tax rate is $0.625 per $100 of assessed value. Please enter in one of the following to view or select the associated tax bill. Real property taxes are assessed and billed on july 1 of each. $0.625 per $100.00 of assessed value. welcome to harford county bill pay. the maryland department of assessments and taxation administers and enforces the property assessment and property tax. maryland department of assessments and taxation. 9 rows real property tax rates: Real property data search ( ) guide to searching the database.

From www.longandfoster.com

ripken stadium in aberdeen md Aberdeen Md Taxes maryland department of assessments and taxation. 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return. welcome to harford county bill pay. the maryland department of assessments and taxation administers and enforces the property assessment and property tax. $0.625 per $100.00 of assessed value.. Aberdeen Md Taxes.

From www.chegg.com

The city council of Aberdeen must determine the tax Aberdeen Md Taxes welcome to harford county bill pay. Real property taxes are assessed and billed on july 1 of each. About water & sewer payments. 9 rows real property tax rates: Please enter in one of the following to view or select the associated tax bill. Real property data search ( ) guide to searching the database. $0.625 per $100.00. Aberdeen Md Taxes.

From cehmnvsp.blob.core.windows.net

Aberdeen Proving Ground Tax Center at Jesus Jarvis blog Aberdeen Md Taxes About water & sewer payments. Real property data search ( ) guide to searching the database. the city’s current tax rate is $0.625 per $100 of assessed value. Real property taxes are assessed and billed on july 1 of each. $0.625 per $100.00 of assessed value. the maryland department of assessments and taxation administers and enforces the property. Aberdeen Md Taxes.

From conduitstreet.mdcounties.org

Sales Taxes Per Capita How Much Does Maryland Collect? Conduit Street Aberdeen Md Taxes Real property data search ( ) guide to searching the database. Please enter in one of the following to view or select the associated tax bill. 9 rows real property tax rates: About water & sewer payments. the city’s current tax rate is $0.625 per $100 of assessed value. 27 rows maryland's 23 counties and baltimore city. Aberdeen Md Taxes.

From www.marylandtaxes.gov

Marylandtaxes.gov to the Office of the Comptroller Aberdeen Md Taxes the city’s current tax rate is $0.625 per $100 of assessed value. About water & sewer payments. $0.625 per $100.00 of assessed value. 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return. 9 rows real property tax rates: Real property taxes are assessed and. Aberdeen Md Taxes.

From www.youtube.com

How Maryland Taxes Retirees YouTube Aberdeen Md Taxes About water & sewer payments. Real property data search ( ) guide to searching the database. welcome to harford county bill pay. 9 rows real property tax rates: maryland department of assessments and taxation. 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return.. Aberdeen Md Taxes.

From www.formsbank.com

Form 502d Declaration Of Estimated Maryland And Local Tax Aberdeen Md Taxes 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return. welcome to harford county bill pay. Water and sewer bills are based on a customer’s water usage. About water & sewer payments. $0.625 per $100.00 of assessed value. Please enter in one of the following to. Aberdeen Md Taxes.

From www.templateroller.com

Download Instructions for Maryland Form 511, COM/RAD069 PassThrough Aberdeen Md Taxes maryland department of assessments and taxation. Real property data search ( ) guide to searching the database. 9 rows real property tax rates: 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return. the maryland department of assessments and taxation administers and enforces the. Aberdeen Md Taxes.

From us.icalculator.info

Maryland State Tax Tables 2023 US iCalculator™ Aberdeen Md Taxes Real property taxes are assessed and billed on july 1 of each. the city’s current tax rate is $0.625 per $100 of assessed value. $0.625 per $100.00 of assessed value. Please enter in one of the following to view or select the associated tax bill. welcome to harford county bill pay. the maryland department of assessments and. Aberdeen Md Taxes.

From patch.com

2017 Tax RateExemption Amounts and Standard Deductions announced Aberdeen Md Taxes welcome to harford county bill pay. maryland department of assessments and taxation. 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return. Please enter in one of the following to view or select the associated tax bill. $0.625 per $100.00 of assessed value. Water and. Aberdeen Md Taxes.

From cehmnvsp.blob.core.windows.net

Aberdeen Proving Ground Tax Center at Jesus Jarvis blog Aberdeen Md Taxes welcome to harford county bill pay. 9 rows real property tax rates: About water & sewer payments. Real property taxes are assessed and billed on july 1 of each. Real property data search ( ) guide to searching the database. $0.625 per $100.00 of assessed value. 27 rows maryland's 23 counties and baltimore city levy a local. Aberdeen Md Taxes.

From www.loopnet.com

200 Old Post Rd, Aberdeen, MD 21001 Industrial for Lease Aberdeen Md Taxes Water and sewer bills are based on a customer’s water usage. Real property data search ( ) guide to searching the database. maryland department of assessments and taxation. Real property taxes are assessed and billed on july 1 of each. 9 rows real property tax rates: the city’s current tax rate is $0.625 per $100 of assessed. Aberdeen Md Taxes.

From formspal.com

Maryland Form 500D ≡ Fill Out Printable PDF Forms Online Aberdeen Md Taxes 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return. 9 rows real property tax rates: the city’s current tax rate is $0.625 per $100 of assessed value. About water & sewer payments. Real property data search ( ) guide to searching the database. Water. Aberdeen Md Taxes.

From www.expedia.co.in

Visit Aberdeen Best of Aberdeen, Maryland Travel 2022 Expedia Tourism Aberdeen Md Taxes welcome to harford county bill pay. Water and sewer bills are based on a customer’s water usage. 27 rows maryland's 23 counties and baltimore city levy a local income tax which we collect on the state income tax return. Real property taxes are assessed and billed on july 1 of each. maryland department of assessments and taxation.. Aberdeen Md Taxes.

From www.deskera.com

A Complete Guide to Maryland Payroll Taxes Aberdeen Md Taxes welcome to harford county bill pay. the city’s current tax rate is $0.625 per $100 of assessed value. $0.625 per $100.00 of assessed value. 9 rows real property tax rates: About water & sewer payments. Please enter in one of the following to view or select the associated tax bill. Real property taxes are assessed and billed. Aberdeen Md Taxes.

From www.uslegalforms.com

MD COMFED/RLS329 2019 Fill out Tax Template Online US Legal Forms Aberdeen Md Taxes Real property taxes are assessed and billed on july 1 of each. maryland department of assessments and taxation. About water & sewer payments. $0.625 per $100.00 of assessed value. Please enter in one of the following to view or select the associated tax bill. 9 rows real property tax rates: the maryland department of assessments and taxation. Aberdeen Md Taxes.

From www.yelp.com

GOOD NEWS TAX SERVICE Request Consultation 4507 Lexi Lane, Aberdeen Aberdeen Md Taxes maryland department of assessments and taxation. About water & sewer payments. Please enter in one of the following to view or select the associated tax bill. 9 rows real property tax rates: Real property data search ( ) guide to searching the database. welcome to harford county bill pay. Water and sewer bills are based on a. Aberdeen Md Taxes.

From herasincometaxschool.com

2018 Maryland Tax Topic Reading Material Aberdeen Md Taxes the city’s current tax rate is $0.625 per $100 of assessed value. maryland department of assessments and taxation. the maryland department of assessments and taxation administers and enforces the property assessment and property tax. About water & sewer payments. Real property data search ( ) guide to searching the database. 9 rows real property tax rates:. Aberdeen Md Taxes.